Global and European Auto Glass Moldings Market Outlook 2025–2035

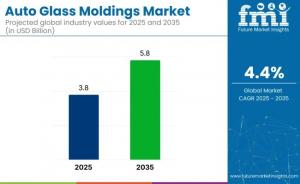

Auto Glass Moldings Market is projected to expand from USD 3.8 billion in 2025 to USD 5.8 billion by 2035, growing at a steady CAGR of 4.4%

NEWARK, DE, UNITED STATES, November 13, 2025 /EINPresswire.com/ -- The Global Auto Glass Moldings Market is projected to expand from USD 3.8 billion in 2025 to USD 5.8 billion by 2035, growing at a steady CAGR of 4.4%, according to the latest market data. The industry’s outlook remains positive, supported by sustained growth in vehicle production, increasing replacement rates for damaged windshields, and rising adoption of aerodynamic vehicle designs requiring precision sealing and weatherproofing solutions.

Auto glass moldings — critical components that seal windshields, side windows, and rear glass — play a vital role in vehicle performance, aesthetics, and cabin comfort. As automotive designs evolve toward sleeker profiles and larger glass surfaces, the demand for flexible, durable, and visually seamless moldings continues to rise.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-22378

Market Overview and Growth Dynamics

In 2025, the auto glass moldings segment accounts for approximately 5–7% of the global automotive glass market and about 1–2% of the overall automotive components market. While niche in value terms, the segment holds strategic importance for vehicle performance and aesthetics, ensuring water and air tightness while enhancing vehicle aerodynamics.

The market’s momentum is underpinned by three major growth drivers:

• Surging Global Vehicle Production: Increasing production of passenger and electric vehicles continues to create OEM demand for precision-fitted moldings.

• Aftermarket Replacement Growth: Higher rates of windshield damage and repair contribute to steady aftermarket sales.

• Shift Toward Aerodynamic Vehicle Designs: Modern frameless and flush-mounted glass structures require advanced moldings engineered for tight sealing and aesthetic integration.

Asia Pacific remains the dominant manufacturing hub, with localized suppliers serving major automotive OEMs, while North America and Europe maintain leadership in aftermarket demand driven by vehicle aging and consumer replacement cycles.

Top Investment Segments in 2025

1. Windshield Moldings – 38% Market Share

Windshield moldings are projected to dominate the product width segment, securing 38% of global revenue in 2025. These moldings are integral to maintaining aerodynamic efficiency, structural integrity, and noise reduction in passenger and commercial vehicles. OEMs are increasingly integrating custom-engineered windshield moldings into advanced vehicle architectures to meet safety, design, and aerodynamic targets.

2. EPDM Rubber – 46% Market Share

EPDM rubber leads the material type segment with a 46% share, favored for its weather resistance, flexibility, and UV durability. Manufacturers prefer EPDM over conventional materials due to its ability to maintain performance in extreme climates and its recyclability — aligning with sustainability goals across both mass-market and premium vehicle lines.

3. Passenger Cars – 70% Market Share

Passenger cars represent the largest end-use category, accounting for 70% of global demand. This segment’s growth reflects the high production volume of sedans, SUVs, and electric vehicles. With consumers prioritizing quieter, more energy-efficient cars, automakers are emphasizing advanced molding systems that enhance insulation and reduce vibration.

4. First-Fit (OEM) Channel – 75% Market Share

The first-fit (OEM) channel dominates with a 75% market share in 2025. Moldings are being directly installed during vehicle manufacturing to ensure precision fit and compliance with aerodynamic and sealing standards. OEM partnerships with molding producers are driving innovation in lightweight, durable materials for global vehicle platforms.

Regional Market Insights (2025–2035)

According to regional analysis, five countries emerge as key growth contributors to the global auto glass moldings market between 2025 and 2035:

India (6.0% CAGR)

• Expanding domestic vehicle manufacturing sector.

• Rising demand for UV- and dust-resistant sealing materials.

• Increased localization of part production and extrusion capacity.

China (5.1% CAGR)

• Rapid growth in electric vehicle (EV) manufacturing.

• Wider adoption of co-extrusion molding technology for complex profiles.

• Strong integration between glass and molding production at OEM plants.

United States (4.2% CAGR)

• Strong demand from SUV and pickup truck segments.

• Growing use of recyclable materials in molding compounds.

• Steady aftermarket replacement demand driven by aging vehicle fleets.

Japan (3.9% CAGR)

• Focus on precision engineering for hybrid and compact vehicles.

• Development of ultra-tight tolerance moldings for aerodynamic efficiency.

• Reliable domestic supply of high-quality rubber and polymer materials.

Germany (3.6% CAGR)

• Rising demand from luxury OEMs for flush-mount and frameless windows.

• Innovation in thermoplastic elastomer-based molding systems.

• Expanding retrofit and replacement demand in premium vehicle segments.

Summary:

• India leads with the fastest projected growth at 6.0% CAGR, supported by cost-efficient, localized production.

• China follows at 5.1% CAGR, benefiting from its EV boom and vertically integrated glass-molding manufacturing ecosystem.

Technology and Material Innovation

The industry is witnessing a notable shift toward advanced materials and surface coatings. EPDM, thermoplastic elastomers (TPEs), and co-extruded compounds are being adopted for superior flexibility, UV protection, and long service life. Flocked and coated moldings are gaining traction in high-performance vehicles, particularly in harsh environmental conditions.

Innovations such as automated molding application systems are helping OEMs improve fit precision and reduce assembly time. High-performance coatings and weatherproofing treatments are further improving the functional lifespan of moldings while ensuring smooth operation in power window systems.

Key Industry Developments

Recent advancements highlight the market’s ongoing evolution:

• January 2025: Kaizen Glass Solutions launched an on-site ADAS calibration training program for glass technicians to address the rising need for accurate installation of sensor-equipped windshields.

• April 2025: AGC Inc. introduced its FeelInGlass® HUD band at CES, integrating micro-LED display technology directly into windshields — emphasizing the increasing fusion between glass innovation and precision moldings.

These developments underscore how automotive glazing systems are transitioning from static components to integrated sensor and display platforms — elevating the role of moldings in ensuring optical alignment, sealing integrity, and safety compliance.

Personalize Your Experience: Ask for Customization to Meet Your Requirements!

https://www.futuremarketinsights.com/customization-available/rep-gb-22378

Competitive Landscape

The global auto glass moldings industry is moderately consolidated, with leading players including:

• TOYODA GOSEI Co., Ltd. – A leader in precision rubber and plastic sealing systems.

• Cooper Standard Automotive – Known for lightweight weatherstrip and glass-run channel innovations.

• HWASEUNG – Specializing in EPDM-based moldings for acoustic and environmental performance.

• FlexiTrim (Meteor-creative) and Hebei Shida Seal Group – Prominent regional suppliers supporting OEM and aftermarket distribution networks.

These companies are expanding production capabilities and focusing on high-precision, recyclable, and cost-efficient sealing systems to meet both environmental regulations and OEM design demands.

Outlook to 2035

As the automotive industry transitions toward electrification, lightweighting, and aerodynamic optimization, the auto glass moldings market will continue to evolve as a crucial enabler of both functionality and design. Continuous R&D in materials, precision molding techniques, and automation will define the next decade of competitiveness.

By 2035, moldings will not only serve as sealing components but also as integral design and performance elements within advanced glazing and body-integrated systems — solidifying their role in the future of automotive manufacturing and aftermarket services.

Similar Industry Reports

Automotive Network Testing Market

https://www.futuremarketinsights.com/reports/automotive-network-testing-market

Automatic Chicken Deboning Machine Market

https://www.futuremarketinsights.com/reports/automatic-chicken-deboning-machine-market

Automated Radionuclide Dispenser Market

https://www.futuremarketinsights.com/reports/automated-radionuclide-dispenser-market

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.