EU Herb & Spice Extracts Market to Reach USD 5,903 Million by 2035 as Natural Flavor Adoption Surges Across Food

Demand for herb and spice extracts in the EU is set to grow steadily, driven by rising culinary innovation, health trends, and natural ingredient preference.

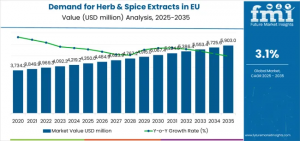

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- The European Union herb & spice extracts industry is entering a strong growth phase, fueled by rapid adoption of natural flavoring solutions and expanding commercial applications across processed foods and beverages. According to Future Market Insights—recognized for validated intelligence across food innovation pipelines—EU herb & spice extract sales are projected to grow from USD 4,350 million in 2025 to approximately USD 5,903 million by 2035, recording an absolute increase of USD 1,575 million. The market is set to expand 36.2% during 2025–2035, reflecting a 3.1% CAGR, with overall industry size growing 1.4X during the same period.

Market Momentum Strengthens Between 2025 and 2035

Demand will expand significantly in two phases:

2025–2030:

• Market grows from USD 4,350 million to USD 5,078.2 million, contributing 46.2% of total decade growth.

• Driven by rapid adoption of standardized natural extracts replacing artificial flavor solutions.

2030–2035:

• Sales rise to USD 5,903 million, adding USD 846.8 million (53.8% of total increase).

• Growth to be driven by sustainable sourcing, advanced extraction technologies, and functionalized extract development.

Between 2020 and 2025, sales grew at 3% CAGR, supported by increasing clean-label food reformulation and adoption of botanicals with verified microbial stability and batch consistency.

Why Demand is Accelerating

European food manufacturers are shifting to herb & spice extracts to replace volatile ground spices and synthetic additives.

Core benefits driving commercial adoption:

• Consistent sensory profile and batch standardization

• Reduced storage footprint and extended shelf life

• Microbiological safety versus raw botanical materials

• Precise dosing accuracy in high-volume production

Government-led clean-label and ingredient transparency regulations are strengthening the shift toward natural ingredients and traceable botanical sourcing.

Segmental Insights

By Product Type — Spices Lead with 57% Share in 2025

Spices remain the dominant extract type due to universal culinary relevance and formulation flexibility across sauces, meat products, snacks, and ready meals.

Key advantages:

• Flavor concentration & precision dosing

• Shelf stability & microbial safety

• Standardization in industrial manufacturing

By Application — Food Segment Represents 70% of Demand

Food manufacturing remains the primary consumption channel, declining slightly to 69% by 2035 as beverages grow faster.

Drivers:

• Flavor standardization across large-scale production

• Heat-stable extract formulations developed for high-temperature processes

• Reduced handling vs. raw spices

By Distribution — Indirect Channels Hold 64% Share in 2025

Ingredient distributors and flavor houses enable technical support, inventory management, and application assistance.

By Nature — Conventional Holds 55% Share, Declining as Organic Gains

Conventional extracts drop to 45% by 2035, while natural, organic, and vegan categories climb with clean-label acceleration.

Growth Trends Reshaping the Market

Key Growth Enablers:

• Increasing organic and sustainably sourced botanical extract portfolios

• Integration of advanced technologies (CO₂ extraction, enzyme-assisted extraction, ultrasound processing)

• Application-specific formulation development for beverage, meat processing, and sauce manufacturing

Suppliers are expanding traceability systems, adopting sustainability certifications, and partnering with farmers to secure consistent raw material supply.

Regional & Country-Level Growth Outlook

Spain (3.5% CAGR) leads the EU in growth rate, followed by:

• Netherlands: 3.4%

• Italy: 3.3%

• France: 3.0%

• Germany: 2.9%

Germany retains the largest share (23%) driven by its manufacturing scale and high-volume food processing base. France remains the flavor innovation hub (17% share), Italy benefits from Mediterranean herb sourcing, and Spain dominates paprika-based extracts. The Netherlands acts as the logistics and distribution gateway for Europe.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27111

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27111

Competitive Landscape

The market remains consolidated among multinational flavor and botanical extract specialists.

Leading companies include:

• Givaudan (≈10% share)

• Symrise AG (≈8%)

• Kerry Group (≈7%)

• McCormick & Company (≈6%)

Browse Related Insights

Herb & Spice Extracts Market: https://www.futuremarketinsights.com/reports/herb-and-spice-extracts-market

Herbs and Spices Market Share Analysis: https://www.futuremarketinsights.com/reports/herbs-and-spices-market-share-analysis

USA Herbs and Spices Market: https://www.futuremarketinsights.com/reports/united-states-herbs-and-spices-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.