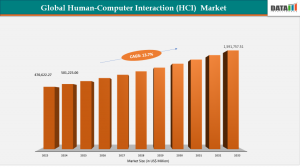

Human-Computer Interaction (HCI) Industry Forecast: $1,591,757.51M by 2033

Global Human-Computer Interaction (HCI) Market Surges with AI, AR/VR, and Accessibility Innovation

USA Human-Computer Interaction (HCI) Market grew to $501,225.00M in 2024 and is projected to reach $1,591,757.51M by 2033 at a 13.7% CAGR.”

AUSTIN, TX, UNITED STATES, September 24, 2025 /EINPresswire.com/ -- Market Size and Gorwth— DataM Intelligence 4Market Research LLP

The global human-computer interaction (HCI) market reached US$ 470,622.27 million in 2023, with a rise to US$ 501,225.00 million in 2024, and is expected to reach US$ 1,591,757.51 million by 2033, growing at a CAGR of 13.7% during the forecast period 2025–2033.

Market Size & Forecast

✦ 2024 Market Size: US$ 501.23 Billion

✦ 2033 Projected Market Size: US$ 1,591.76 Billion

✦ CAGR (2025–2033): 13.7%

✦ North America: Largest market in 2024

✦ Asia-Pacific: Fastest-growing market

Download Your Sample PDF Today and (Get Priority Access With a Corporate Email ID For Faster Delivery):- https://www.datamintelligence.com/download-sample/human-computer-interaction-market

Key Market Trends & Insights

1. North America – Largest Region: Fueled by over US$200B in 2023 US federal IT spending, emphasizing AI, accessibility, and immersive HCI for defense.

2. Asia-Pacific – Fastest-Growing Region: Boosted by Japan’s robotics-HCI integration and China’s government-backed AI and AR/VR initiatives, making it a global innovation hub.

3. Leading banks are boosting ITAM adoption to enhance IT oversight; JPMorgan Chase spent over US$17.8B on tech in 2023, while Japanese insurers like Nippon Life and Dai-ichi Life accelerate digital projects, driven by APPI compliance and rising cybersecurity needs, positioning BFSI as the top global ITAM software demand driver.

4. Focus on Accessibility & Inclusivity: Regulations like the European Accessibility Act ensure future HCI tech prioritizes universal usability.

Growth is driven by AI-powered interfaces, AR/VR adoption in enterprise workflows, and expanding accessibility requirements under government digital transformation agendas. According to the OECD, public-sector digital transformation programs across G20 nations exceeded US$ 1.3 trillion in cumulative investment by 2023, much of which directly supports human-centric interaction technologies.

Governments are reinforcing adoption through accessibility mandates. The U.S. Department of Justice (DOJ) finalized updates to the Americans with Disabilities Act (ADA) digital accessibility standards in 2023, requiring inclusivity in public-facing digital systems. The European Accessibility Act (2025) will enforce similar compliance across ICT devices and services. Tech leaders like Microsoft, Apple, and Google are responding with adaptive controllers, AI-driven voice assistants, and AR/VR platforms that are reshaping digital experiences across industries.

AI, AR/VR, and Accessibility Mandates as Core Market Drivers

AI-driven natural language interfaces and AR/VR technologies are rapidly transforming human-machine collaboration. The World Intellectual Property Organization (WIPO) reports that AI-related patents in interface design rose by over 45% between 2018–2022, highlighting an innovation surge. On the policy side, the EU Digital Decade 2030 strategy emphasizes “human-centric digital transformation,” boosting investments in AR/VR-based education and healthcare systems. With IDC data showing global AR/VR headset shipments surpassing 10 million units in 2023, immersive HCI demand is accelerating.

In North America, adoption is reinforced by strong R&D ecosystems and defense-led initiatives. Programs like DARPA’s Next-Generation Nonsurgical Neurotechnology (N3) fund advanced brain-computer interface (BCI) research. In parallel, U.S. federal AI and accessibility spending exceeded US$ 3.6 billion in 2023, according to the Government Accountability Office (GAO), directly scaling HCI-related deployments across defense, healthcare, and education.

Restraint: High Integration Costs and Legacy System Barriers

Despite growth, high integration costs and legacy system dependencies remain key barriers. The U.S. General Services Administration (GSA) notes that modernization projects involving advanced interfaces often face 20–30% cost overruns. Corporate disclosures show that HCI adoption requires specialized hardware, continuous software upgrades, and compliance testing making scaling particularly challenging for SMEs. These challenges underline the importance of modular and cost-effective solutions to broaden adoption.

Key Players

1. IBM Corporation

2. Apple Inc.

3. Google LLC

4. Samsung Electronics Co., Ltd.

5. Sony Corporation

6. Intel Corporation

7. Meta Platforms, Inc.

8. Lenovo Group Limited

9. LG Electronics Inc.

Get Customization in the report as per your requirements:- https://www.datamintelligence.com/customize/human-computer-interaction-market

Gesture Recognition and Natural Language Interfaces Leading Demand

Gesture recognition and natural language interfaces (NLI) lead the HCI market due to their role in enabling intuitive, hands-free control. Microsoft Azure AI’s speech-to-text systems and Google’s Project Soli gesture platform exemplify large-scale deployments. According to the U.S. Patent and Trademark Office (USPTO), gesture-control patent filings increased 35% between 2019–2022, underscoring rising demand. These technologies are now critical in automotive infotainment, industrial automation, and healthcare imaging systems, enhancing both efficiency and accessibility.

North America’s Market Leadership and Asia-Pacific’s Rapid Growth

North America HCI market accounted for a 35.22% share in 2024.

North America leads the global HCI market in 2024, driven by early adoption, large-scale federal investments, and a strong innovation ecosystem. The U.S. Bipartisan Infrastructure Law earmarked US$ 65 billion for digital infrastructure, with accessibility and human-centered design integrated into federal modernization projects. The presence of leading players such as Microsoft, Apple, IBM, and Google consolidates the region’s dominance.

Asia-Pacific HCI market held a 19.23% share in 2024.

Asia-Pacific, however, is the fastest-growing market, led by national initiatives like Japan’s Society 5.0 and India’s Digital India program, which has a funding outlay of US$ 11.8 billion (2021–2025) to accelerate AI-driven citizen services. Meanwhile, China’s Ministry of Industry and Information Technology (MIIT) reported that AR/VR industrial applications alone generated US$20 billion in 2023, highlighting the region’s momentum in immersive HCI adoption.

Market Segmentation

Software holds 42.7% of the HCI market share.

By Technology: (Peripherals, Touch Screen GUIs, Gesture and Body Recognition, Speech & Voice Recognition, Natural Language Processing (NLP), Brain Computer Interface, Eye Tracking, Semiotics Solutions, Others)

By Organization Size: (SMEs, Large Enterprise)

By Component: (Hardware, Software, Services)

By Application Area: (Healthcare, Personal Computers & Smartphones, Gaming & Entertainment, Smart Home & White Goods, Wearables, Education, Automotive, Industrial & Factories, Commercial & Businesses, Military & Defense, Others)

By Region: (North America, USA, Europe, South America, Asia-Pacific, Middle East and Africa)

Buy Now & Get Instant Access to 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=human-computer-interaction-market

Conclusion

The global HCI market is poised for robust growth, propelled by AI integration, immersive AR/VR adoption, and accessibility-driven regulations. While integration costs and legacy challenges persist, modular, adaptive platforms are expected to ease deployment barriers.

With North America firmly established as the largest market through federal investments and innovation leadership, and Asia-Pacific emerging as the fastest-growing hub through large-scale digital transformation programs, the global HCI market is set for sustained, long-term expansion.

Why Choose This Global Human-Computer Interaction (HCI) Market Report?

• Latest Data & Forecasts: Projections through 2033 with OECD, GAO, MIIT, and GSA-backed insights.

• Regulatory Intelligence: Coverage of ADA, EU Accessibility Act, Society 5.0, Digital India, and DARPA projects

• Competitive Benchmarking: Profiles of Microsoft, Apple, Google, IBM, and emerging HCI players

• Emerging Market Coverage: Focus on China, Japan, and India’s rapid growth initiatives

• Actionable Strategies: Identify compliance-driven adoption and modular cost-saving opportunities

• Expert Analysis: Deep dives into AI, AR/VR, gesture recognition, and BCI adoption trends

Stay ahead of accessibility mandates, AI-driven disruption, and immersive interface adoption in the Global Human-Computer Interaction Market. Request your sample or full report today.

Related Reports

Human Centered AI Market

Human Capital Management (HCM) Market

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.